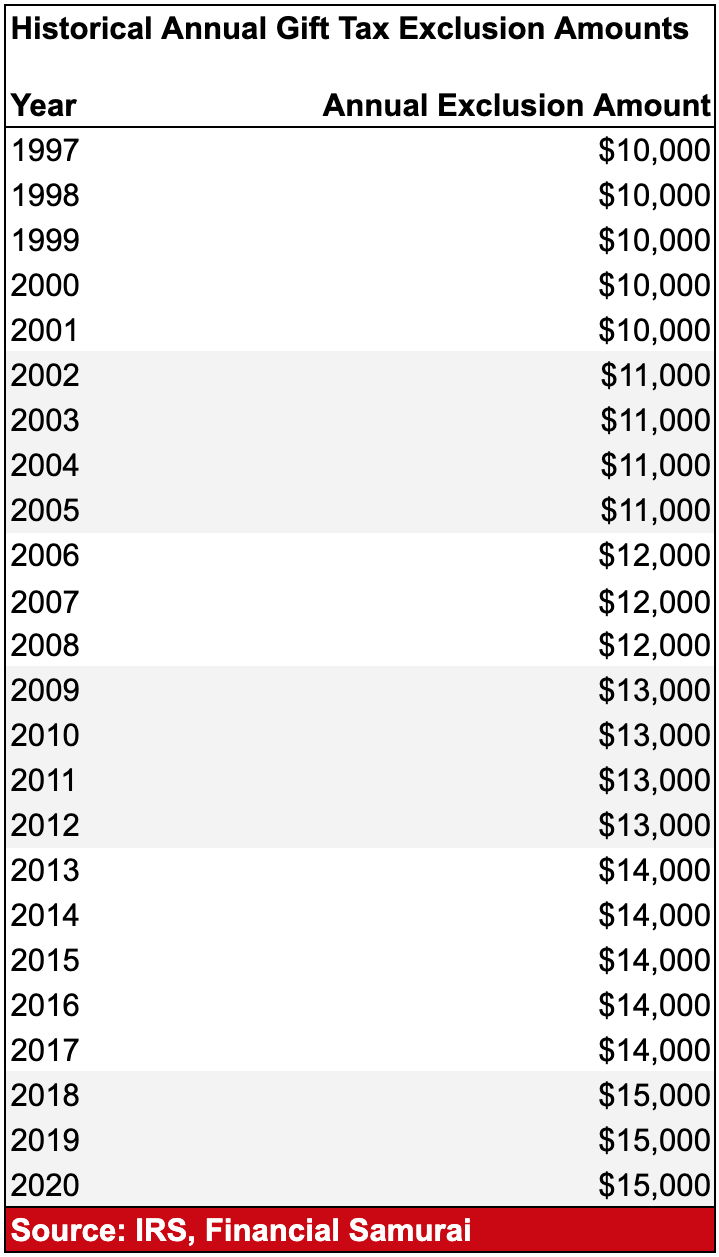

2025 Gift Tax Exclusion Amount Limit. The irs has announced that the annual gift tax exclusion is increasing in 2025 due. You may also use the lifetime exclusion amount to make larger gifts.

Here are the new exemption amounts for estate tax, gift tax, and generation skipping transfer tax exemptions amounts and the annual exclusion amount for 2025: In other words, giving more.

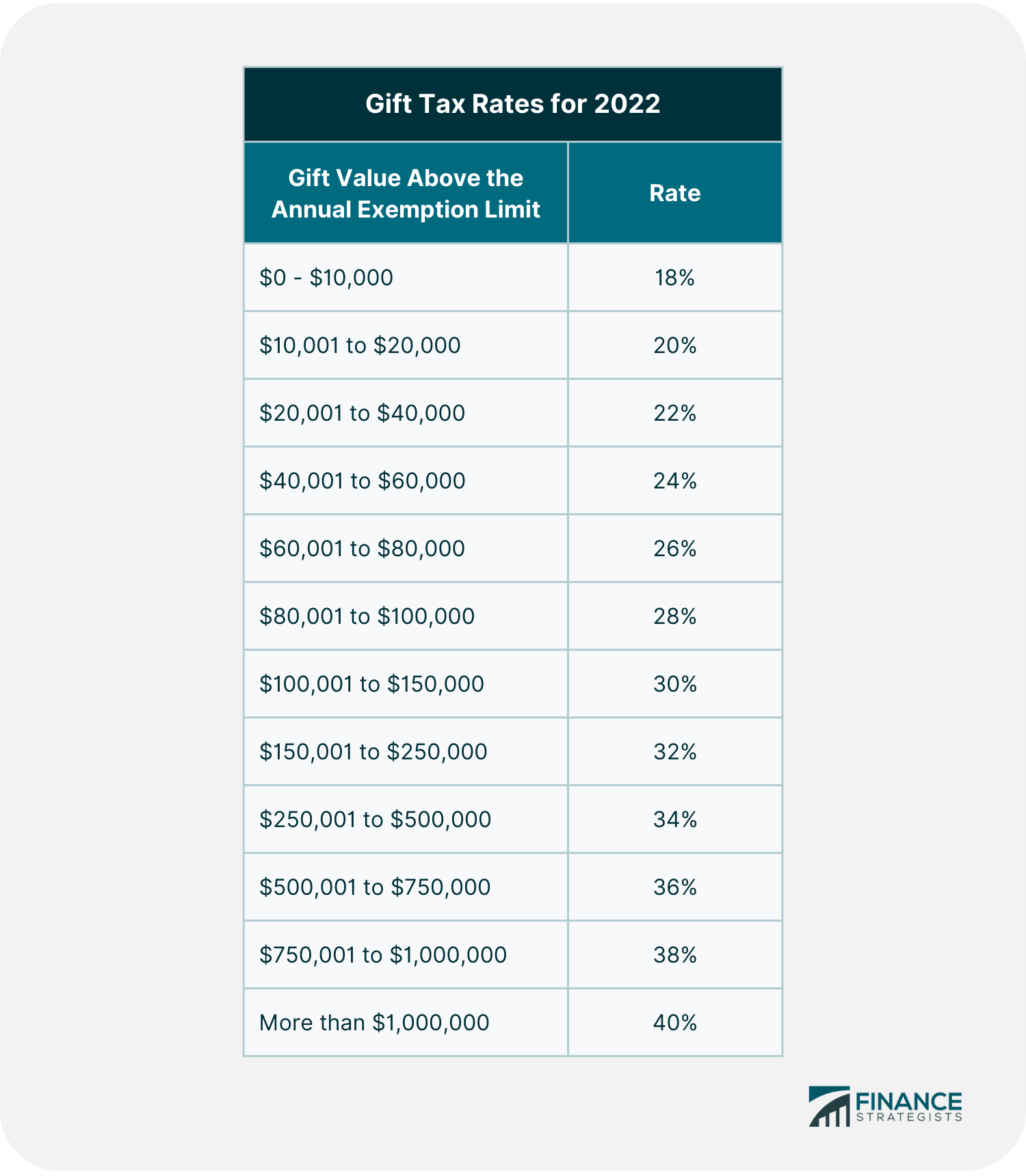

Gift Tax Exemption 2025 Understanding The Lifetime Exclusion And Its, Any gift above the annual exclusion limit reduces your lifetime exclusion amount, which is the same as.

Lifetime Gift Tax Exclusion 2025 Irs Carl Graham, The unified estate and gift tax exclusion amount, $13,610,000 for gifts made and decedents dying.

2025 Annual Gift Tax Exclusion Nelli Libbie, Under the old tax regime, an individual can claim a.

2025 Gift Tax Exemption Amount Betta Charlot, The excess amount above $18,000 will count toward your lifetime gift exemption, which in 2025 is $13.61 million.(this exemption amount will be raised to $13.99m in 2025, but.

2025 Annual Gift Tax Exclusion Nelli Libbie, Under the old tax regime, an individual can claim a.

Gift Tax 2025 Limit 2025 Zoe Lyman, For 2025, the irs has set the annual gift tax exclusion at $18,000 per individual.